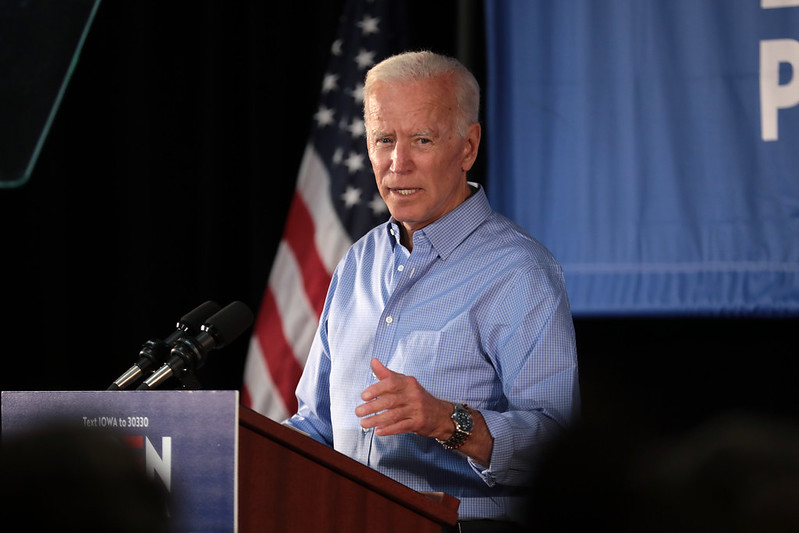

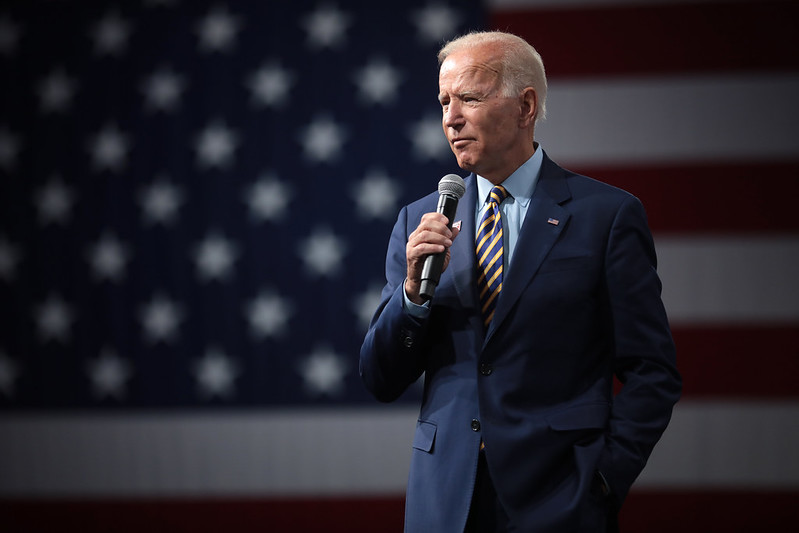

The Biden administration has announced updated regulations for the Paycheck Protection Program in order to ensure funding reaches small business owners. The new regulations will limit loan applications under the program to businesses with fewer than 20 employees for the first two weeks of the new application period, which begins on February 24.

The new rules will also alter some eligibility requirements for applicants with felony records, outstanding student loans and uncertain citizenship status.

In a statement released by the White House, the administration said the revamped program is aimed at ensuring “equitable relief to hard-hit small businesses,” as well as rooting out waste, fraud, and abuse.

Last year, the Small Business Administration and Trump administration officials came under criticism for approving loans to large corporations while blocking assistance to so-called “Main Street” businesses.

The PPP is part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion aid program ratified by Congress last March to provide relief to business owners who have suffered significant drops during the corona crisis.