With the addition of two new oil rigs operating in the Gulf of Mexico 16 new ones across the US, there are now a total of 653 drilling for oil and gas.

It is good news for the oil industry, but those numbers are far below the number of rigs operating in 2014 and 2015. According to numbers released last week by the Houston-based oilfield-services company Baker-Hughes, this year’s number is lower by 47 since last year, and is still 65 percent lower than the 1,882 which were pumping out oil and gas at the end of 2014.

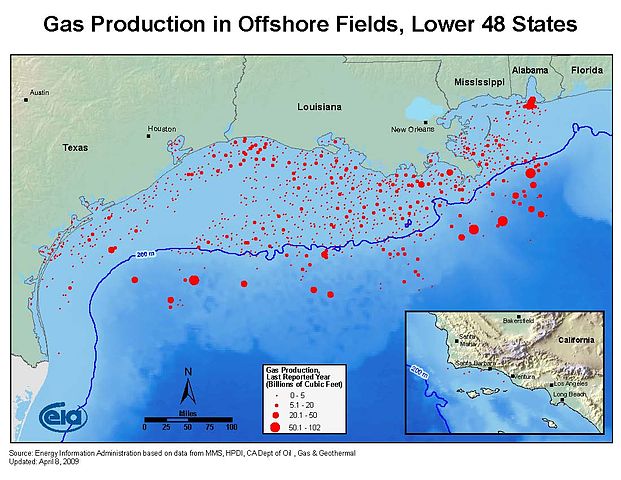

Of the 653 rigs working today, 129 are looking for natural gas and the remainder, 523, are bringing out oil.

The oil industry has been suffering as an oil glut continues to keep prices of oil low. Caused by a growing trend of drilling in US shale fields, combined with increased oil production by OPEC, the oil glut brought oil prices to half, and lower, than their mid-2014 high of $115 per barrel.

Lower oil prices froze exploration for new sources of oil and natural gas, and many people in the industry were laid off. The fact that the US rig count has been growing and now is higher than its been since January, could be a harbinger of better times for the industry.