According to the US Labor Department, the unemployment rate for the month of September 2019 fell to only 3.5% from 3.7% the previous month. An additional 136,000 jobs were added to the economy.

There was also additional retroactive good news as August’s figures for job growth was updated to 168,000 instead of what had been reported to be 130,000. Some manufacturing jobs last month while wage growth held steady.

The increase in jobs in September was below what has been the monthly average of about 161,000 for the year, but it was still above the number the economy requires every month to stay in line with the growth of the working age population, which is 100,000. The manufacturing sector lost 2,000 jobs in September, after employing an additional 2,000 workers in August.

Manufacturing has been doing poorly across the globe, but it is less a factor in employment than it has been in the past, since modern economies have been transferring away from reliance on this sector.

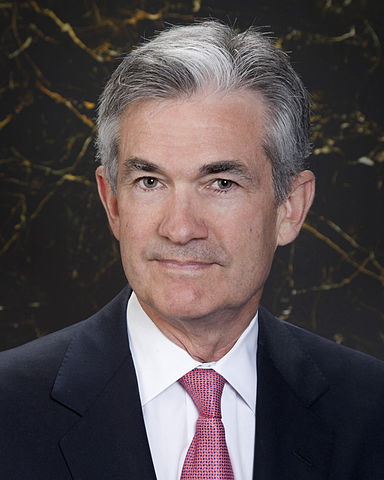

Despite the positive news on jobs, however, will probably not relieve the pressure on Federal Reserve head Jerome Powell to cut interest rates. The US Federal Reserve Bank cut interest rates for the first time since 2008 in July, and then did it again in September. The bank would like to keep what is so far the longest economic expansion in US history–11 years—moving forward.