This article was originally published on January 17, 2014.

Based on the Forbes article from May 29, 2000 entitled: “The Gift of Data”

As CEO of a cancer testing startup, Anu Saad has leveraged her company’s vast trove of patient data to launch a lucrative new business in packaging and selling medical information.

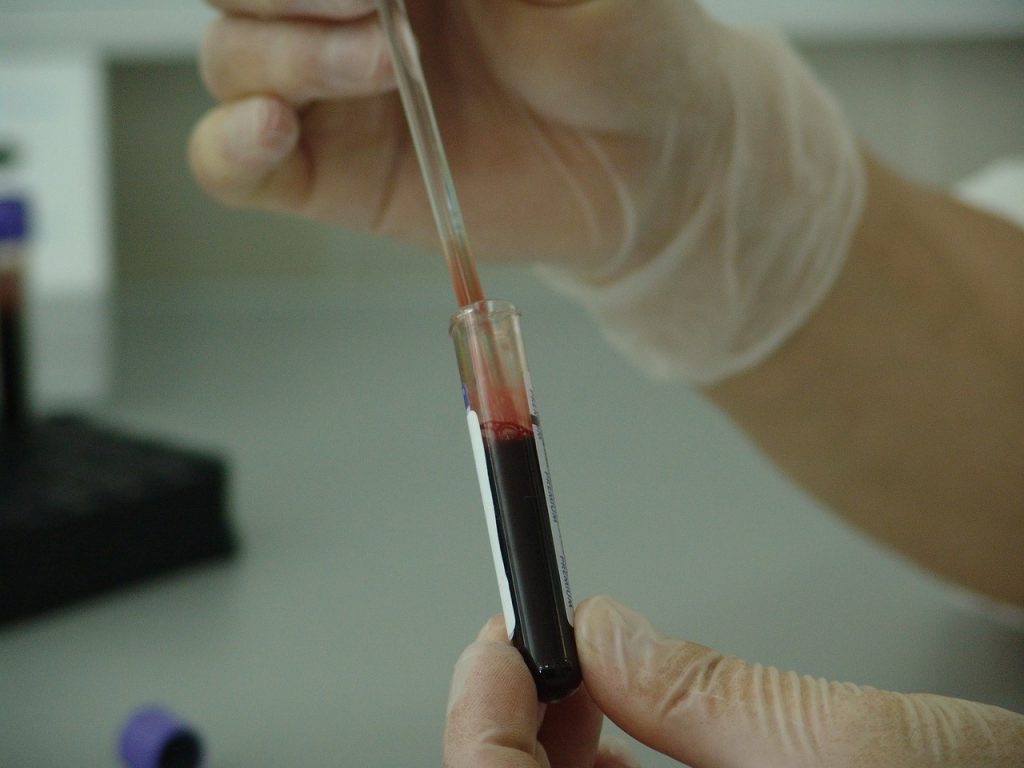

In 1998, Saad provided critical usage insights to Genentech on its new breast cancer drug Herceptin by analyzing her startup’s database of 40,000 HER2 gene test results. This allowed Genentech to effectively target pre-launch marketing, contributing to Herceptin’s blockbuster sales of $300 million in 2000.

Under Saad’s leadership, the startup realized rich opportunities in monetizing its cancer databases. With over 565,000 patient profiles and processing 12% of US cancer screens annually, Saad has signed partnerships with two dozen pharmaceutical firms who pay handsomely for analysis of biomarkers, genetics, treatment outcomes and more. For example, Novartis paid the startup to analyze bone metastasis rates across different cancer types to inform clinical expansion opportunities for its breast cancer drug Zometa.

To expand the startup’s data capabilities, Saad recently acquired two firms – one for clinic data and tumor samples and another for 1.7 million cancer patient records. By pooling these resources with the startup’s internal databases, Saad has developed detailed profiles on over 100,000 patients to better inform treatment and drug development.

While the lion’s share of the startup’s $85 million revenue still comes from core cancer testing services, Saad has overseen over 50% growth in its information services business, already generating $8 million annually. However, Saad stresses that commercialization of data is firmly grounded in achieving the fundamental mission she set out for her company – leveraging medical insights to develop more effective diagnosis and treatments for cancer patients. It is this commitment by visionary leaders like Saad that enables life sciences firms to translate vast data resources into improved patient outcomes. Under Saad’s leadership, her startup has emerged as an information powerhouse that promises to catalyze major advances in cancer care.